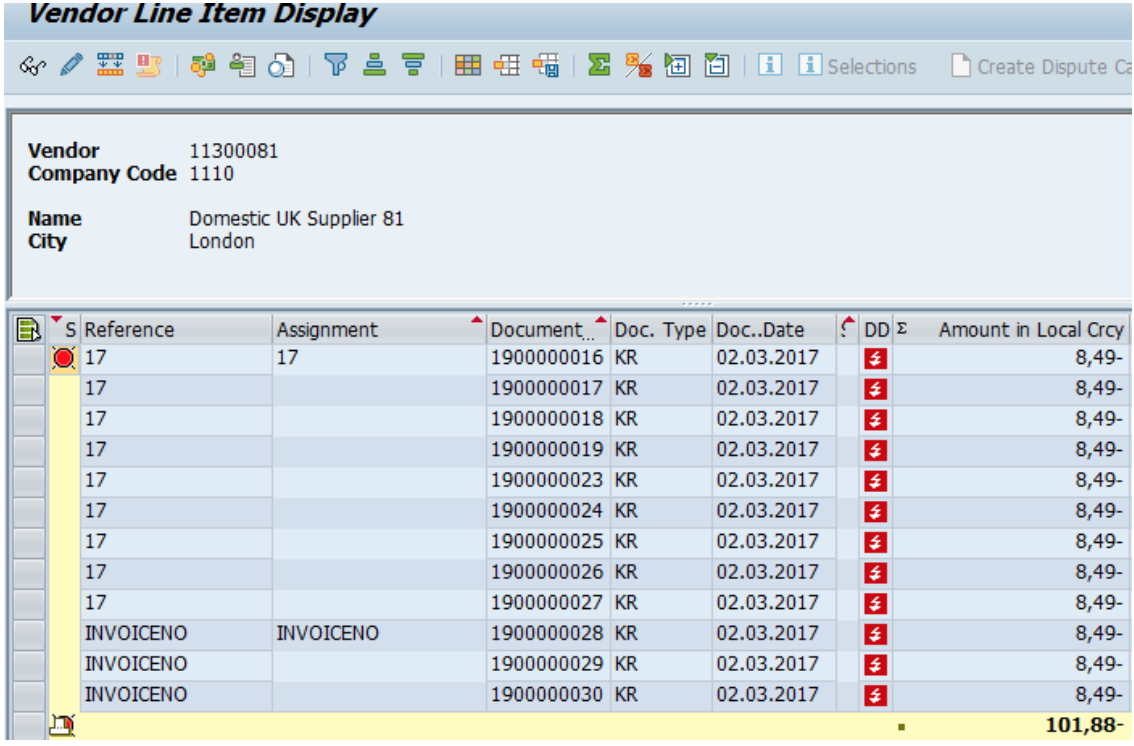

By clicking on the vendor number in the body of the report, you will be redirected to the vendor master data (held in the Business Partner transaction)

Credit Management

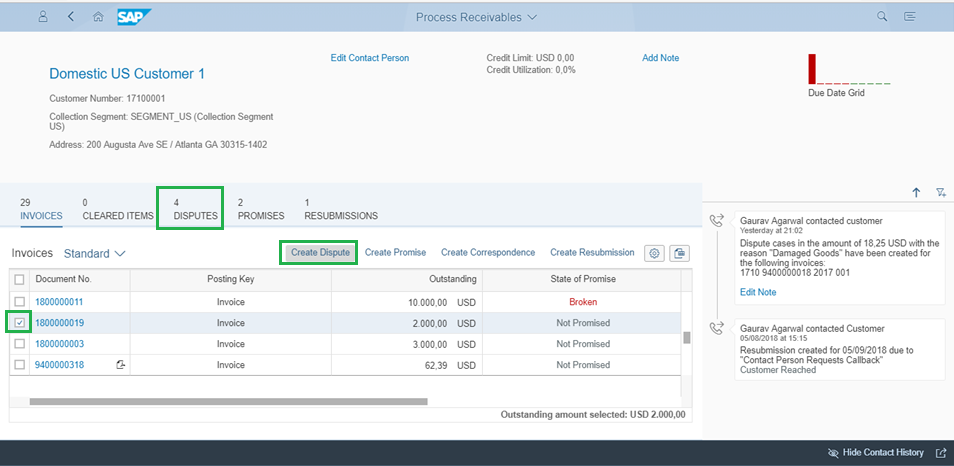

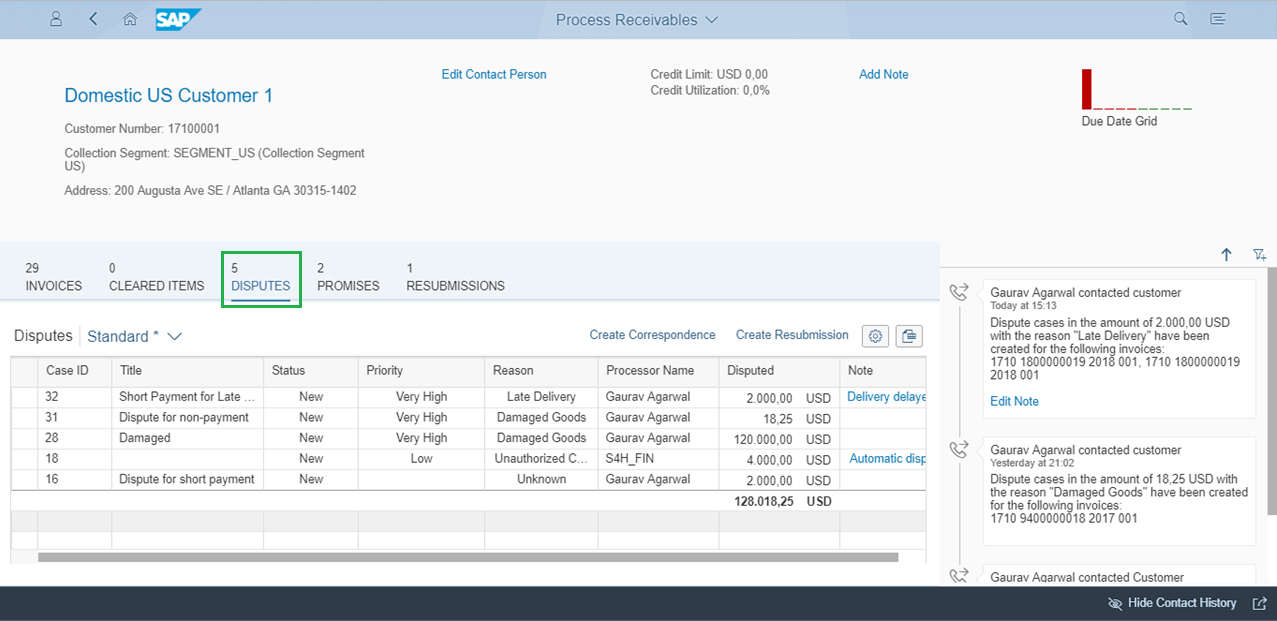

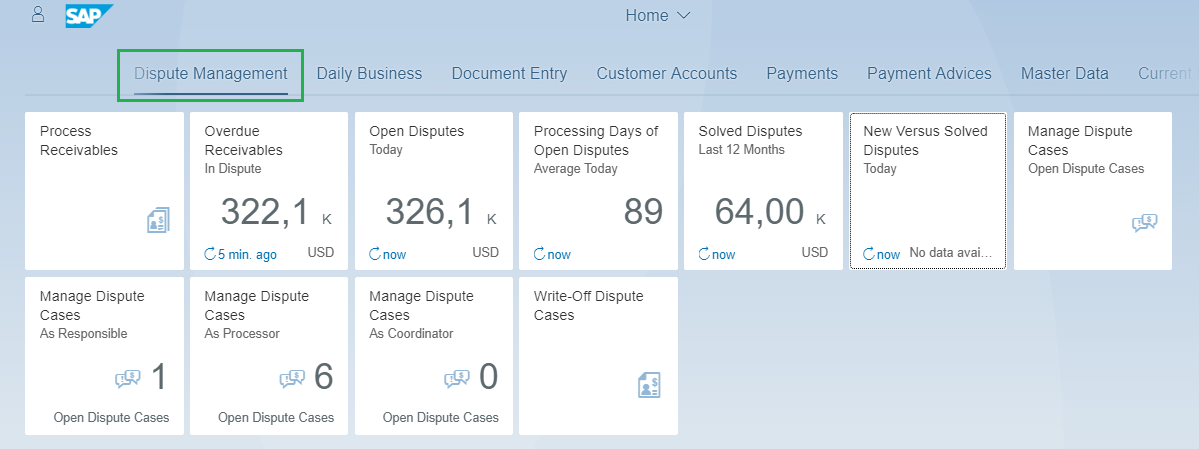

FSCM replaces the previous Accounts Receivable credit management transactions (e.g. F.28/F.31/F.32/F.33/FD32) and the Sales transactions (VKM3/VKM5). If you are not already familiar with FSCM, this already used the Business Partner functionality prior to S/4HANA and has additional functionality, in areas such as Credit Management, Collections Management (including collection worklists), Dispute Management. It also has additional reporting and allows you to import external credit information.

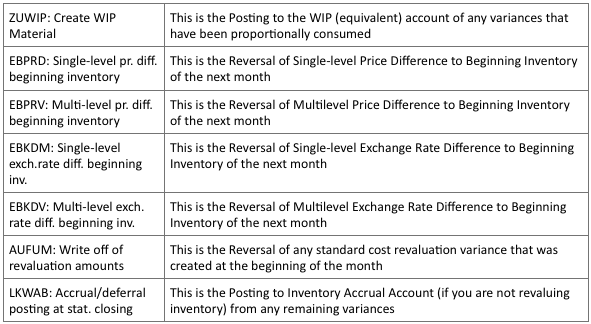

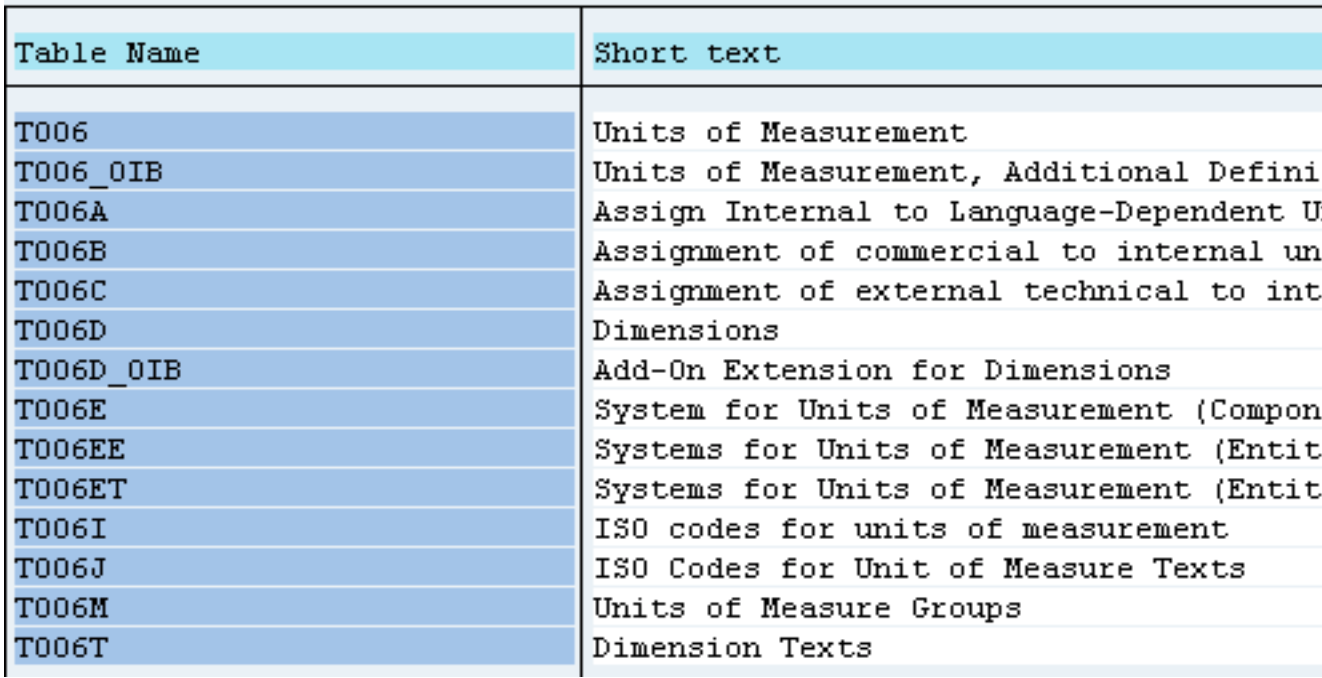

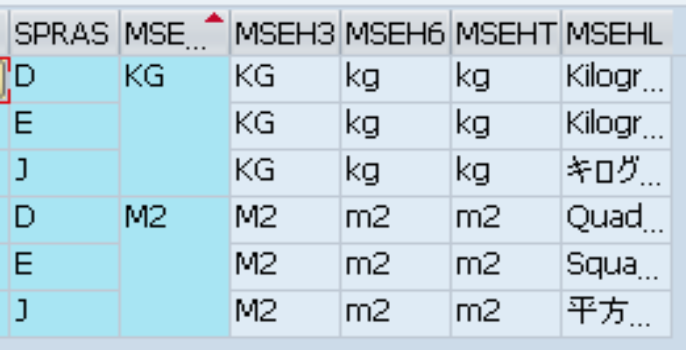

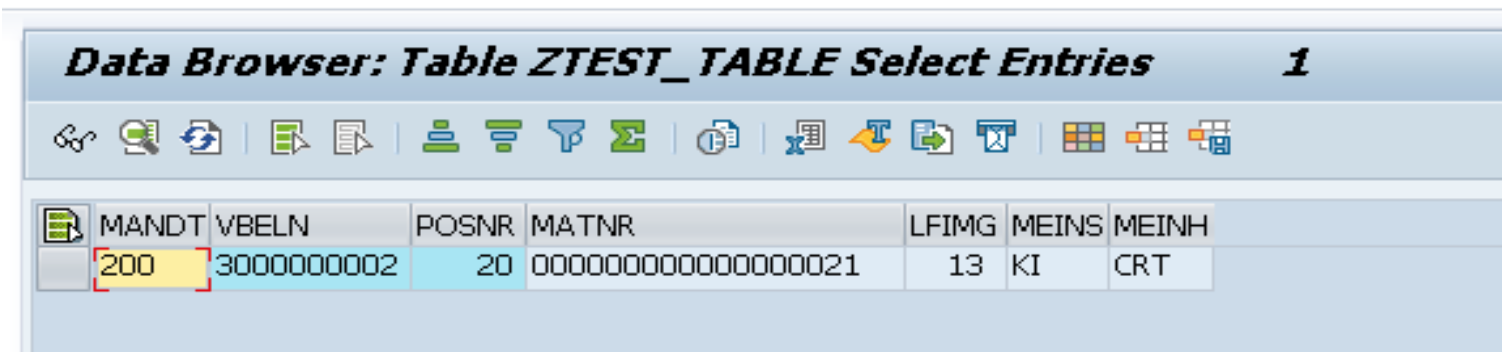

Materials

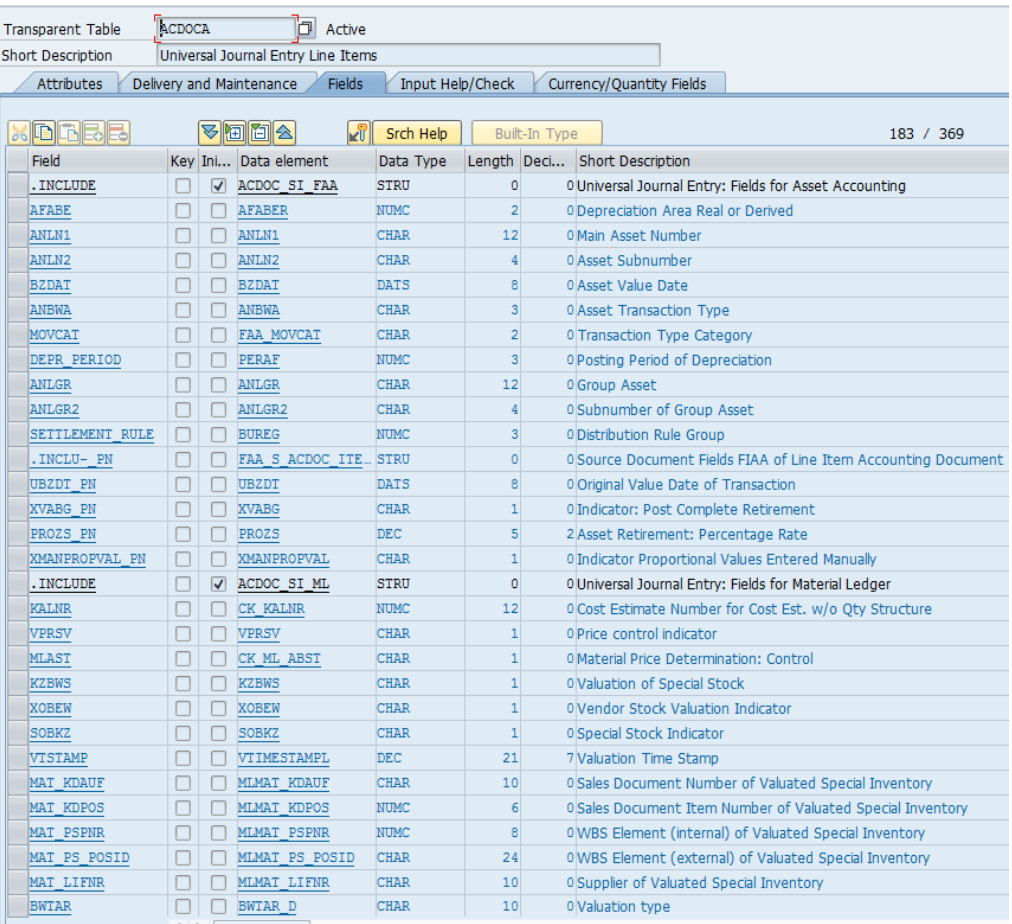

The Material Ledger is mandatory (although Actual Costing is still optional) and there are also new tables for material documents (MATDOC), a Cost of Goods Sold variance split and no locking of tables. The material number field is extended from 18 to 40 characters and this information is available in the Universal Journal document, and therefore the ACDOCA table for reporting in finance. Note that the extended material functionality can be switched off if for example you have a multi-system landscape.

Global trade Services (GTS)

GTS replaces the foreign trade functionality in Sales and Procurement. This allows the pulling in of data from different systems, and is extensively integrated with SD and MM.

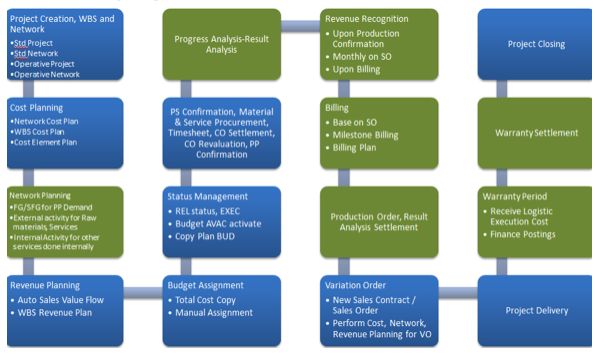

Revenue Recognition

Only the new Revenue Accounting and Reporting, which supports IFRS15, is available in S/4HANA, i.e. the SD Revenue and Recognition is no longer available.

LSMW

The Legacy System Migration Workbench is still available in S/4HANA, but it is not recommended for migrations as it has not been amended for the new data structures, and some functionality is not available e.g. transaction recordings cannot be made with the Fiori transactions.

The Maintenance Planner tool has to be used for a system conversion, which among other things, checks add-ons, active business functions and industry solutions to ensure that they can be converted.

Central Finance

Central Finance is a new concept introduced with S/4HANA. It allows users with a large and distributed landscape to replicate both SAP and non-SAP finance data real-time to a central S/4HANA system, but still allowing drilldown to the original document in the SAP systems.

Cash Management

There is a suite of programs, Cash Operations, Bank Account Management (BAM) and Liquidity Management that replace the classic cash and liquidity management, and you can centrally manage the actual and forecast cash positions from SAP and non-SAP systems by using the One Exposure operations Hub. Transactions such as FF7A and FF7B (cash management and liquidity forecast) are now Fiori apps.

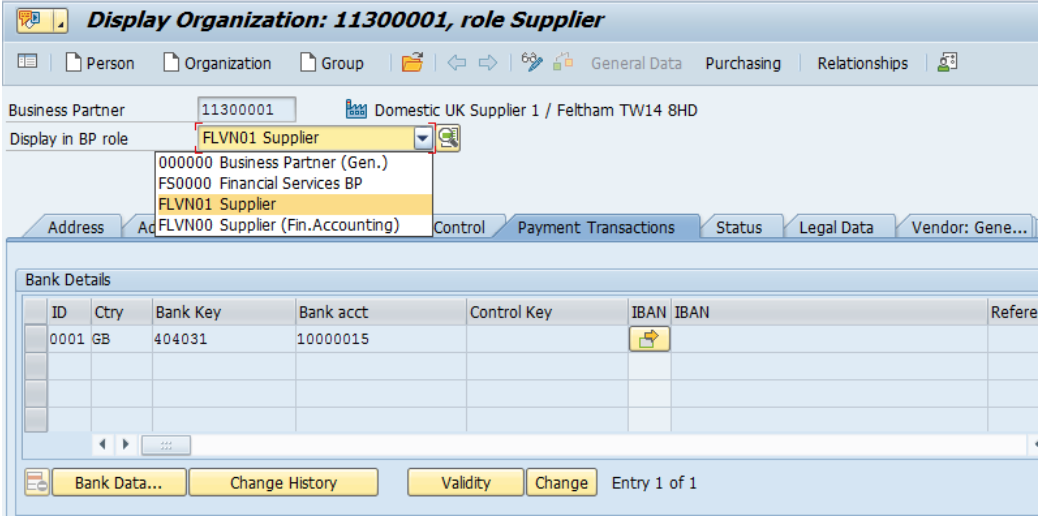

House banks and house bank accounts, which are now master data, can be managed by users in Fiori, along with banks hierarchies or groupings, overdraft limits, signatories and approvals flows and additional reporting such as the foreign bank account report, helps compliancy. The hierarchy uses the bank business partner role

Bank accounts can also be downloaded and uploaded to and from Excel, for reporting, migrations and mass changes. They are created in the productive system, but still need to be replicated to the development and quality assurance systems etc. as configuration for payments and bank statements still needs to be made in the development system and moved through quality to production as usual.

If you don’t want to implement the full Bank Account Management (BAM), then Basic Cash management is also available, previously known as BAM Lite.

Other Fiori apps available include for cash operations include the Incoming bank statements monitor, cash payments and approvals, cash position reports, transfers, cash pooling.